Conflicting priorities of policymakers, the financial sector, and changed customer demands

We are at a turning point. This has been evident at the latest since the European Green Deal was unveiled by Ursula von der Leyen on the occasion of her accession to the office of President of the European Commission on 11 December 2019. This road map for a sustainable EU economy has since found its way into the countries’ national legislation. The aim: to make the European Union climate-neutral by 2050. The path adopted: promotion and increasing regulation. And this has consequences for the building sector.

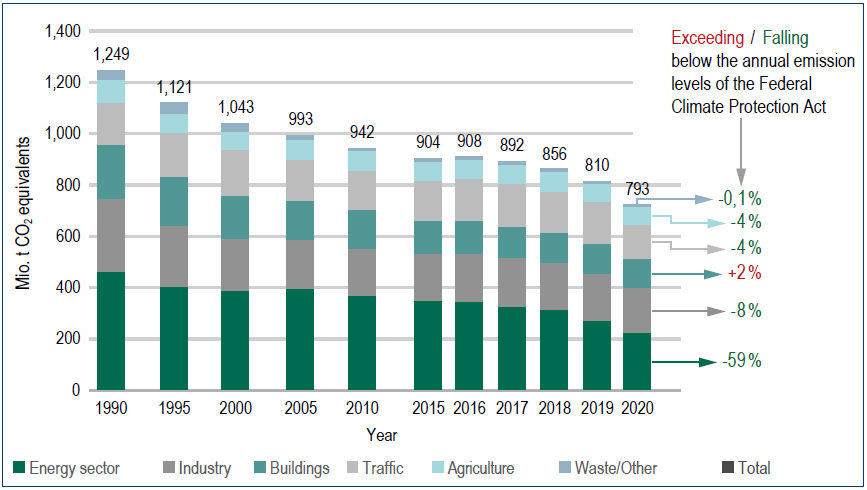

When the German Environment Agency (UBA) presented its environmental footprint data for 2020 on 16 March of this year, it became apparent that Germany’s climate protection targets for 2020 had been achived, but that the building sector has strayed from the climate direction path.

Emissions of CO2 equivalents (CO2e) were cut by three million tonnes to 120 million tonnes in 2020, but the target for 2020 was missed by two million tonnes. By more, in fact, as some of the reduction was attributable to the sub-sectors especially hard hit by the pandemic, namely the commercial, trade, and service sectors (–4 million tonnes of CO2e). The policymakers will respond to ensure that the target of 72 million tonnes of CO2e by 2030 is achieved. Measures in this regard are expected in July 2021.

The German Federal Environment Ministry calculates: Greenhouse gas emissions in Germany are falling (emissions development 1990 - 2020)

Increased pressure due to regulatory measures

The price being paid for climate change is indisputibly increasing. This applies to the economy too. In addition to physical risks such as as damage caused by extreme weather events, companies also need to take what are known as transformation risks into account. These include risks caused, for example, future regulations, changes in demand for rental space, or changes in building material prices as a consequence of a serious climate protection policy. To counter these risks, all building owners are called upon to build up their climate protection activities, for example regarding the recording and reduction of greenhouse gas emissions.

If the policymakers wish to stick to their climate protection targets for building stock, there needs to be more work than ever in the area of reducing primary energy consumption by 50% while covering the residual demand with renewable energies. How these targets can be achieved largely depends on the creativity of the legislation. However, various studies show that the time of ‘promotion first’ is slowly running out. The energy efficiency upgrade rates are stagnating in spite of ample subsidies for such upgrades, and the price introduced in early 2021 for tonnes of carbon emitted during heat generation will likely have only a limited steering effect due to its form and level.

Germany’s federal government is currently looking into effective instruments to help this along in a targeted way, such as the extension of minimum standards to additional energy-consuming products like central heating systems, furnaces and ovens, machine tools, boilers and servers. Neighbouring European countries are going one step further. For example, France and the UK are obliging homeowners to meet minimum energy standards, while the Netherlands is stipulating minimum energy standards for large office buildings from 2023.

The Dutch government announced the gradual introduction of minimum standards (initially) for office buildings in its 2018 Energy Agreement. This stipulates that no office building may be below energy efficiency class C as of 2023, otherwise the owners face a letting ban. Even before the minimum standards enter into force, many owners have begun to reduce their consumption, driven among other things by increased demand from the banks and investment funds which have invested in the real estate or which serve as lenders.

Climate protection as an economic performance indicator in the financial sector

‘Climate risk is investment risk’ – a much-cited assertion made by Philipp Hildebrand, Vice Chairman of BlackRock, which is the world’s largest asset manager, with 7.5 trillion dollars of assets under management. Turning this around, this means the financial sector will increasingly have to take an investment’s climate protection impact into account, because of political requirements. An array of political frameworks and regulations can be grouped together under the buzzword ‘sustainable finance’. All of these seek to ‘protect’ the financial market from increasing climate change risks – and conversely to steer more investments into sustainable activities on the basis of risk awareness.

These include sustainability criteria – in 2018, the European Commission commissioned a classification system known as EU taxonomy for this. This will enter into force at the end of 2021 and will make companies’ sustainability activities quantifiable. In addition to energy consumption, the policymakers are turning their attentions to the carbon footprint.

This involves the counting of the emissions caused in the course of a building’s operation and, in the future, most likely also during its construction. At the national level, the federal government’s Sustainable Finance Committee comprising 38 experts from the fields of science and business advises that financial institutions be obliged to disclose sustainability risks relating to their lending business starting at a defined threshold and that building energy quality be taken into account in the financial valuation of real estate.

In addition to the policymakers’ requirements and growing risk awareness within the financial market, a third transformation risk is currently coming to light for the owners of commercial real estate – changing demand on the part of institutional tenants. Tenants are increasingly demanding evidence that buildings and floor space meet climate protection requirements, often driven by the increased weighting of sustainability aspects for their own value added, be it for regulatory reasons, reasons of brand perception or employee acquisition. Sustainability criteria are thus evolving into hygiene factors which are critical to success and are increasingly giving those who are prepared for them a competitive edge. Together, this all results in heightened pressure to act for investors and real estate owners – and, as part of this, also in new areas of action and opportunities for building service providers.

Prospects for building service providers According to a report by the German Energy Agency (dena), the operation of approximately 2.7 million commercially used buildings in Germany causes more than 15 % of Germany’s total carbon emissions. This illustrates just how resource-intensive the management of commercial space is in Germany – and emphasises the importance of facility management, or FM for short, when it comes to achieving the climate protection targets. But what can owners and investors do and what part can FM play? Three propositions:

FM facilitates transparency

Everything starts with data acquisition. The disclosure regulation for financial service providers which entered into force in March 2021 already makes technical building service providers essential for the collection and processing of the building data required. This incidentally equally applies to the building service providers themselves if they contribute to their client’s carbon footprint in the course of considering a company’s upstream and downstream business activities (cf. also GEFMA Guideline 162-1). A formal contribution is made by what are known as green lease agreements for the optimum sustainable use and management of usable floor space, for example concerning the avoidance of waste, the regulation of maintenance, and modernisation measures on the basis of environmental aspects and resource and energy efficiency.

FM facilitates efficiency

The efficiency potential that lies in operational optimisation is demonstrated by, for example, the operational centre that Caverion Germany runs in Munich. The energy engineers here are able to manage and optimise consumption remotely. The building data collected can be used to identify patterns based on condition, usage time and usage requirements that help to reduce energy consumption and carbon emissions – by up to 30%. What’s more, on-site maintenance can be significantly reduced.

FM facilitates value enhancement

Policy requirements and the requirements of the financial sector will encourage building owners to focus not only on resource and energy efficiency in the future. There are already signs that buildings which are run sustainably are more economical and achieve higher average values. This was the finding of, for example, a study conducted by Maastricht University together with the financial institution ING Groep. According to the study, buildings that met specific sustainability criteria generated gross rental income which was 17% higher, an occupancy rate which was 9% higher and a transaction price which was on average 11% higher than that of buildings that did not meet the same criteria. What is needed is therefore strategic approaches to identifying the ‘climate sinners’ within a building portfolio and then modernising them accordingly. For example, an Excel tool developed by Deutsche Unternehmensinitiative Energieeffizienz (DENEFF) has shown that buildings face a loss of value of up to 40% if they cease to meet the regulatory requirements.

However, these innovative FM fields do come with conditions. For example, a profound understanding is needed of the changing customer demands against a backdrop of the changed influence of policymakers, the financial sector and the tenants. There is additionally a need for the flexibility to be able to identify one’s own areas of action early on and then systematically expand them. And closer collaboration is needed among strategic partners both within and outside of FM, as is already practised by numerous companies.

Conclusion

At a time when tenants are increasingly calling for quantifiable climate protection, the financial market is still tentatively but nevertheless determinedly attaching sustainability criteria to capital and both Brussels and Berlin are countering missed carbon emission targets with penalties or tighter regulation, investors in and the owners of commercial real estate will have to restructure their sustainability management and make it a core process. The same consequently applies to building service providers too. Clients will increasingly be taking a look at a company’s upstream and downstream activities. This means they will be considering the entire supply chain or services and thus also the carbon footprint of the building service companies/ the services they provide.

On a positive note, an expanded set of specifications for building service providers is outweighed by the opportunities this will offer them. Preserving a property’s value is, after all, the overarching purpose of FM, which is given an additional dimension with climate protection. Energy services and advice and also management concepts for the avoidance of waste or for electromobility are just a few examples of things that will find their way into tender procedures and/or bills of quantities. Measures to reduce a building’s carbon footprint will follow and will increase in importance. Companies need to hone their understanding of the outlined influencing factors to future customer requirements. They need to systematically further develop their existing digital approaches. And they need to critically question their own role and modify their portfolio of services accordingly, and in the process remain open to new, transgressive paths.

This article was co-authored by DENEFF, the German Industry Initiative for Energy Efficiency, and Caverion.

Susann Bollmann

Member of Management & Head of Projects at DENEFF

Holger Winkelsträter

Head of Marketing & Communications at Caverion Germany